| The Market Mood: Uncertainty Everywhere This is the type of market everyone hates — the kind where nobody knows whether to pull the trigger or sit tight. The uncertainty is exhausting. In my 23+ years in real estate, I’ve never seen a market like this one. Normally, if sales are slow, rentals are steady — or vice versa. But right now, both are in a slump. |

Rentals: Bigger Homes Are Moving, But Barely

On the rental side, the only properties moving with any consistency are the larger ones but even they are moving slowly. Families are doubling up, roommates are teaming up, and affordability is the driver behind every move.

As Las Vegas is first and foremost a tourist destination, any dip in tourism immediately ripples through the local economy. Fewer visitors mean job hours get cut, tips shrink, and service workers scale back spending. That financial strain quickly trickles into housing decisions — and it’s showing in the rental market.

Right now, Las Vegas is being hit from multiple sides:

Job hours are cut due to fewer international visitors (tariffs and global uncertainty).

Californians pulling back as Vegas becomes less of a “cheap getaway.”

Rising costs for things that used to be bargains — parking, buffets, and entertainment.

The result? People are tightening budgets, consolidating households, and putting off moves — which slows rental activity right along with the economy.

Here’s the takeaway: Rental demand is soft but not gone. Larger homes are still leasing as people are combining households, while smaller and mid-range rentals are sitting. It’s less about whether people need housing and more about how many people can share it.

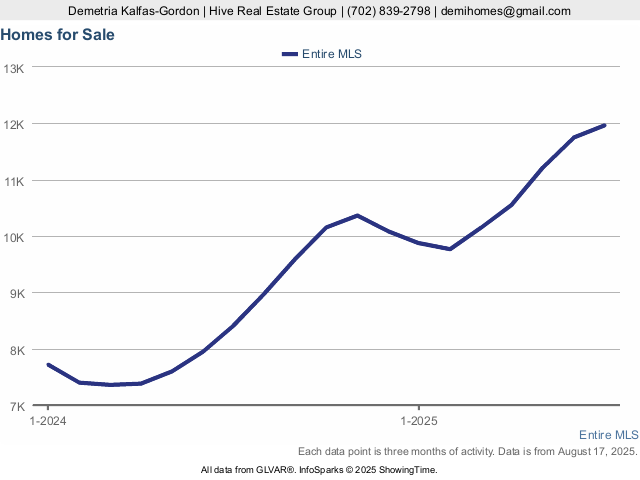

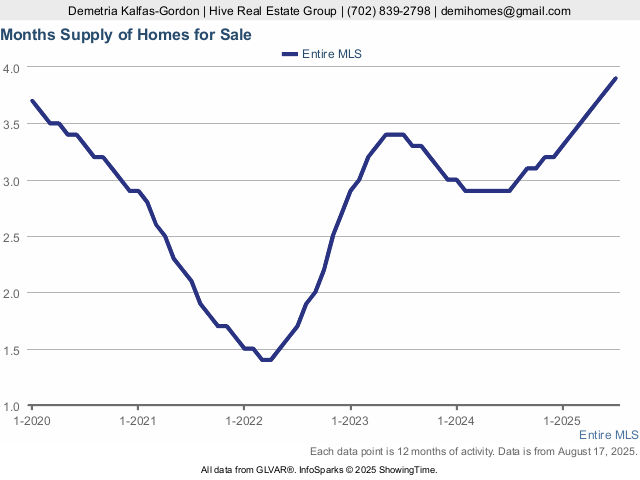

Sales: Record Inventory, But No Real Buyer’s Market Drive through almost any neighborhood in Las Vegas right now and you’ll see it – “For Sale” signs on nearly every block. Inventory is flooding the market at record levels, yet buyers are hesitating. The latest Clark County housing data (July 2025) shows how unbalanced the sales side has become compared with last year: |  |

|  |  |

|

|  |

Even with this surge in inventory, pending sales are down 5.1% year-over-year, with the average pending price at $608,553. On top of that, the housing affordability index shows the squeeze:

Single-family homes: 63

Condos/Townhomes: 106

(Source: LVR MLS, July 2025

Here’s the Paradox:

More homes are listed than ever and buyer showings are at an all-time low – classic signs of a buyer’s market.

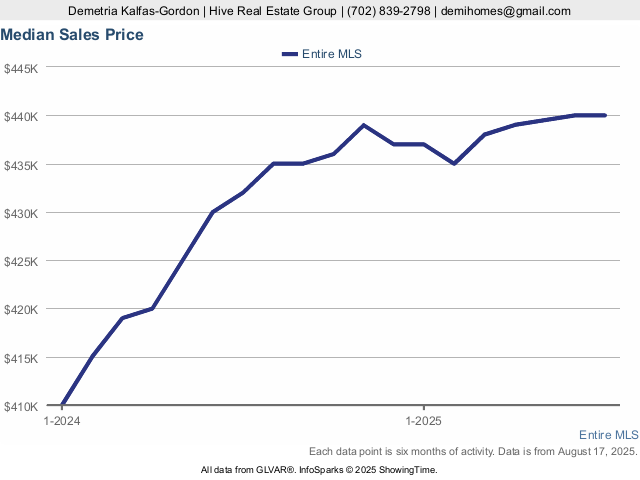

Yet median prices continue to rise and sellers are still getting 99.1% of their list price – both hallmarks of a seller’s market.

This gap clearly highlights what many families are feeling — single-family homes are slipping out of reach, while condos and townhomes remain the more realistic option.

Normally, this kind of setup would swing the pendulum toward buyers. Instead, many are frozen on the sidelines, waiting for one of two things:

Neither has happened. Prices are holding firm, and rates haven’t loosened. The result? A standstill — both buyers and sellers are stuck in limbo — like a giant teeter-totter where no one wants to make the first move. |  |

The Bottom Line

This isn’t a pretty market. Both sides are holding their breath, waiting for something to give. But real estate is always cyclical. Today’s stagnation won’t last forever — and when things shift, those who were prepared will be the first to benefit.

Interested in navigating this market? Reach out and let us see how we can help you.

Contact Us

HIVE RE Group & Property Management, Las Vegas, NV

(702-839-2798

www.hiverealestatelasvegas.com

We specialize in guiding buyers, sellers, and investors through every market cycle — and this one is no exception. Let’s talk strategy.

Thank you for being part of the HIVE – and don’t forget to share and tag us using #JOINOURHIVE, #hiveregrouplv, and #beeecomefamily

Disclaimer

All market statistics are sourced from LVR MLS and are deemed reliable but not guaranteed.